How does this work?

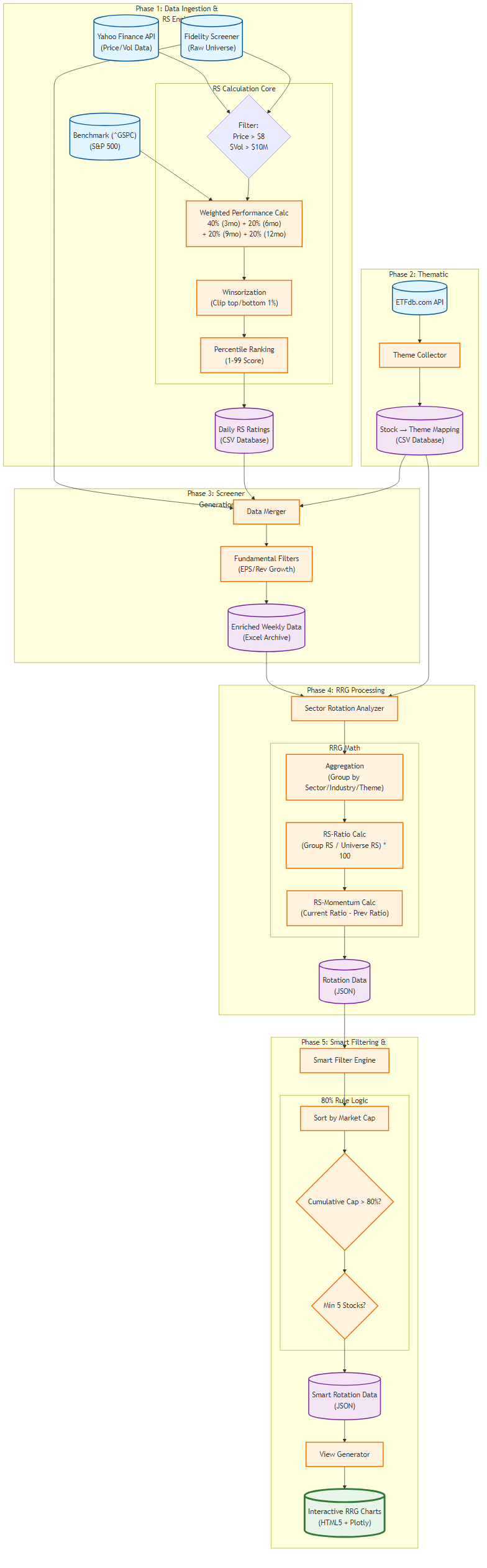

The analysis transforms raw market data into rotation signals through a 4-step pipeline:

Data & Scoring

500+ stocks analyzed weekly for relative strength (RS Rating 0-100)

Smart Filtering

Significance-based filtering tracks important groups across time

RRG Calculation

Calculate RS-Ratio (vs market) and RS-Momentum (rate of change)

Visualization

Interactive Plotly charts showing rotation across 4 quadrants

Understanding the Quadrants

- Leading: Strong & Getting Stronger

- Weakening: Strong but Slowing Down

- Lagging: Weak & Getting Weaker

- Improving: Weak but Waking Up